Business Mileage Deduction 2024

Business Mileage Deduction 2024 – The IRS mileage rate tax deduction is critical for many individuals and businesses. Understanding the current rates can lead to significant tax savings. TRAVERSE CITY, MI, US, October 10, 2023 . For 2024, the lowest rate of 10% will apply to individual with taxable income up to $11,600 and joint filers up to $23,200. The top rate of 37% will apply to individuals making above $609,350 and .

Business Mileage Deduction 2024

Source : www.motus.com

What Will the 2024 IRS Mileage Rate Be? | TripLog

Source : triplogmileage.com

2024 IRS Mileage Rate: What Businesses Need to Know

Source : www.motus.com

IRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.com

What Will the 2024 IRS Mileage Rate Be? | TripLog

Source : triplogmileage.com

IRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.com

2024 IRS Standard Mileage Rates (Business, Medical, etc)

Source : mileagepad.com

IRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.com

Personal Tax Preparation Update 2023: by Kian, Ferey

Source : www.amazon.com

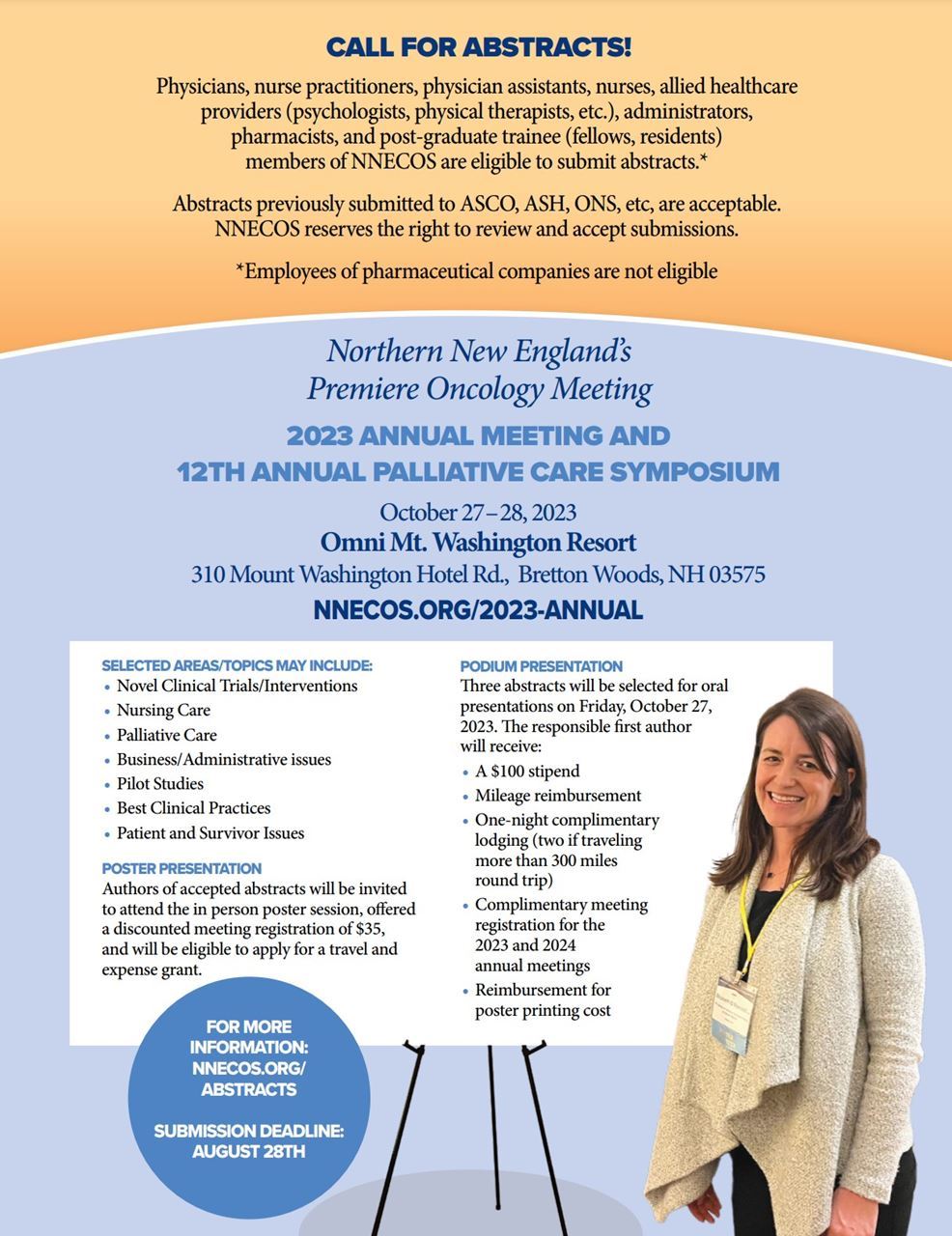

Northern New England Clinical Oncology Society Annual Meeting

Source : www.nnecos.org

Business Mileage Deduction 2024 2024 IRS Mileage Rate: What Businesses Need to Know: The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you . The inflation-adjusted elements will apply to the 2024 tax year, meaning returns filed in 2025. The standard deduction, which reduces the amount of income you must pay taxes on, is claimed by a ma .